I saw a speech last week by a guy named Mark Sellers, the principal and founder of a small hedge fund called Sellers Capital. While the guy may not be a "household name" he was an impressive speaker and really stood out among the many great speakers I have seen in my time here at this institution.

What stood out in his talk were what he called "the most important personality traits of great investors" that he has observed in investors that he follows and studies.

He thinks that these are hard-wired...so if you don't have them, too bad. Not sure if I agree about that point, but here they are in no particular order from my notes:

1) The ability to buy stocks while others panic and sell when others are euphoric.

2) Being obsessive about playing the game and wanting to win. First thing they think about when they wake up is a stock or risk in the portfolio. They have a hard time in personal relationships...their head is always in the clouds.

3) Willingness to learn from mistakes. Intense desire to learn from mistakes to avoid repeating them.

4) Inherent sense of risk based on common sense. For instance, in Long-Term Capital a great investor would have stepped back and said "hey…we are over-levered". The greatest risk control is common sense, and people ignore common sense.

5) Confidence in their convictions and stick with them even when people criticize them. This is why he focuses on large concentrated bets.

6) Important to have both sides of your brain working. Need inventive ways to solve problems. The goal here is to use creativity to be an entrepreneurial investor. Of course you need to perform calculations and have a logical thesis, but you need to be able to step back. And most importantly – you must be a good writer. Almost always a fund blows up because of quants.

7) Ability to live through volatility without changing your thought process. It is hard to average down. Few investors can handle the volatility. People irrationally equate short term volatility with risk. Short term volatility is NOT a risk. Just don’t sell.

Sunday, October 28, 2007

Saturday, October 27, 2007

The Best Headline Ever

This is really the coolest headline I have seen in awhile...

Nintendo to sell Wii in China

It represents the future: growth in China + growth in wicked-cool content distribution channels.

I went to a talk last week with the new manager of Fidelity's famous Magellan fund. He said he is not worried about global growth even with a domestic slowdown primarily because of China's unstoppable expansion.

I kinda agree...the future is gonna be cool.

Nintendo to sell Wii in China

It represents the future: growth in China + growth in wicked-cool content distribution channels.

I went to a talk last week with the new manager of Fidelity's famous Magellan fund. He said he is not worried about global growth even with a domestic slowdown primarily because of China's unstoppable expansion.

I kinda agree...the future is gonna be cool.

Thursday, October 25, 2007

The Schism Continues

I didn't realize when I posted Calling Another Top that we would shortly head into a few consecutive bloody weeks. But I guess I continue to underestimate how much people really have faced the fact that we are entering a prolonged period of a credit cycle.

Thankfully...I believe the technology side of the economy is going to continue to perform and will keep us booming ahead.

There was great news after-hours today when Microsoft beat earnings, only a day after investing in Facebook at a $15B valuation. Both of these things are signs of a strong and agressive tech sector. Not to mention the fact that lifecasting on www.justin.tv and other recent developments show that innovation is continuing at a rapid pace.

I am sure all of you saw the Merrill Lynch write down yesterday (biggest in history) and there was another article in the Journal today about CDO's and how they are to blame...yada yada. I feel like that horse is so dead and beaten that everyone can see it rotting. But then again, I thought everyone could see the house of cards last year.

I think we may start to see some positive movement again in the equity markets (and my PA will for sure with MSFT and JMBA, who also beat revenue estimates after hours...plus NTDOY raised their forecast again). But I am not sure that I am gonna cover my financial shorts. Still more ugly to come. And people don't want to face it.

P.S. Bank of America apparently is shutting down their I-banking group or scaling it back significantly. More to come? I don't see how there can't be. No liquidity - no balance sheets - no pitches - no deals - no fees - no bankers.

Oh, and check out www.twitter.com if you haven't yet. People are obsessed.

Thankfully...I believe the technology side of the economy is going to continue to perform and will keep us booming ahead.

There was great news after-hours today when Microsoft beat earnings, only a day after investing in Facebook at a $15B valuation. Both of these things are signs of a strong and agressive tech sector. Not to mention the fact that lifecasting on www.justin.tv and other recent developments show that innovation is continuing at a rapid pace.

I am sure all of you saw the Merrill Lynch write down yesterday (biggest in history) and there was another article in the Journal today about CDO's and how they are to blame...yada yada. I feel like that horse is so dead and beaten that everyone can see it rotting. But then again, I thought everyone could see the house of cards last year.

I think we may start to see some positive movement again in the equity markets (and my PA will for sure with MSFT and JMBA, who also beat revenue estimates after hours...plus NTDOY raised their forecast again). But I am not sure that I am gonna cover my financial shorts. Still more ugly to come. And people don't want to face it.

P.S. Bank of America apparently is shutting down their I-banking group or scaling it back significantly. More to come? I don't see how there can't be. No liquidity - no balance sheets - no pitches - no deals - no fees - no bankers.

Oh, and check out www.twitter.com if you haven't yet. People are obsessed.

Friday, October 19, 2007

Its Raining Outside

The fall is officially here in Cambridge and the darkness outside is mirroring the hammering that the stock market is taking today. The financials are getting pummelled in the wake of continuing write-offs and the recognition that people like me are not just doomsdayers for no good reason. In addition, if the stock price is any indication it looks like people are predicting the worst for IMB (one of the largest remaining mortgage brokers) - for what it's worth, I think the jury is still out on this one.

It is not just me who thinks that the bailout agreed to earlier this week is a bad idea. Apparently Mr. Greenspan thinks that this is significantly different from the LTCM bail out and that what it amounts to is an attempt at creating liquidity in a market where it doesn't exist. I see it as creating a false "bid" where there are no buyers, but this could be the same thing - i.e. making a "market-maker" where noone wants to be caught holding the hot potato.

And for good reason. Apparently one of the "SIV's" that the fund is supposed to bail out is now in default. This one has only about $6b worth of assets, but I could imagine it is the first of many that are on the brink: Cheyne Finance SIV Defaults on Commercial Paper

Here is the article discussing Greenspan's critique: Greenspan criticises ‘superfund’

It is not just me who thinks that the bailout agreed to earlier this week is a bad idea. Apparently Mr. Greenspan thinks that this is significantly different from the LTCM bail out and that what it amounts to is an attempt at creating liquidity in a market where it doesn't exist. I see it as creating a false "bid" where there are no buyers, but this could be the same thing - i.e. making a "market-maker" where noone wants to be caught holding the hot potato.

And for good reason. Apparently one of the "SIV's" that the fund is supposed to bail out is now in default. This one has only about $6b worth of assets, but I could imagine it is the first of many that are on the brink: Cheyne Finance SIV Defaults on Commercial Paper

Here is the article discussing Greenspan's critique: Greenspan criticises ‘superfund’

Tuesday, October 16, 2007

Bailout Murmurs

As expected the banks announced yesterday that they are banding together to execute the bailout of their structured credit vehicle holding cells (referred to as SIV's).

This article does a good job walking through the implications step by step (thanks to WLH):

Enron, Subprime and the Derivative Disease

To be fair, it looks like the Treasury is already responding to the swipes that people have taken (similar to the sentiments expressed on this blog and in articles like this: Paulson Credit Push Earns Jeers From Free-Marketers) that this bail out is not the best medicine for bad behavior.

Paulson Plans to Review Off-Balance Sheet Bank Units

At the same time, in the same speech he mentioned the obvious fact that many of us have known for quite some time, to which the markets reacted with a downturn over the last few days:

And headines like these, dont look like they are going anywhere anytime soon:

Southern Calif. home sales plunge 30 pct in Sept

This article does a good job walking through the implications step by step (thanks to WLH):

Enron, Subprime and the Derivative Disease

Led by names like Citigroup (NYSE:C) and JPMorgan (NYSE:JPM), the supposed "super conduit" seeks to make attractive assets which now seem dead orphans. A number of banks and other dealers are increasingly illiquid and face losses on supposedly off-balance sheet conduits or structured investment vehicles ("SIV"), losses that in extreme cases could damage their solvency.

To be fair, it looks like the Treasury is already responding to the swipes that people have taken (similar to the sentiments expressed on this blog and in articles like this: Paulson Credit Push Earns Jeers From Free-Marketers) that this bail out is not the best medicine for bad behavior.

Paulson Plans to Review Off-Balance Sheet Bank Units

At the same time, in the same speech he mentioned the obvious fact that many of us have known for quite some time, to which the markets reacted with a downturn over the last few days:

``The ongoing housing correction is not ending as quickly as it might have appeared late last year,'' Paulson said. ``It now looks like it will continue to adversely impact our economy, our capital markets and many homeowners for some time yet.''

And headines like these, dont look like they are going anywhere anytime soon:

Southern Calif. home sales plunge 30 pct in Sept

Saturday, October 13, 2007

Another Big Bailout

The poor underwriting standards of lending institutions look like they are about to get another bailout...and this time it isn't in the form of a Fed rate cut.

It now looks like the banks who have been scrambling to figure out a way to refinance special interest vehicles that have suffered substantial losses and still face large exposures to subprime mortgages are now banding together in coordination with the Treasury department to create a special fund for the sole purpose of holding their toxic securities.

There are tons of articles floating around on Bloomberg and the cover of WSJ, but here is a good one:Banks May Pool Billions to Stop Securities Sell-off

As the WSJ says:

I have been talking about the remaining challenges in the CP and bond markets for awhile, but surprisingly the equity markets have been resilient even while these banks have been working directly with the Federal government on this massive bailout. It seems a bit insincere for the powers-that-be to continue to tout a "strong economy" over the last few weeks while working behind the scenes on staving off a further crisis in our capital markets. These seem to be inconsistent phenomena.

And the fundamentals continue to get worse...and at least one rating agency is finally calling off the formality of putting CDO's on a watch list before continuing to tell the truth about how bad things are getting:

Moody's may accelerate CDO rating cuts after review

It now looks like the banks who have been scrambling to figure out a way to refinance special interest vehicles that have suffered substantial losses and still face large exposures to subprime mortgages are now banding together in coordination with the Treasury department to create a special fund for the sole purpose of holding their toxic securities.

There are tons of articles floating around on Bloomberg and the cover of WSJ, but here is a good one:Banks May Pool Billions to Stop Securities Sell-off

As the WSJ says:

The proposal echoes the 1998 bailout of the hedge fund Long Term Capital Management, when a group of big banks came together to prevent the fund from collapsing after it made a series of bad bets. And the current round of crisis-driven collaboration illustrates the heightened level of concern among both government and financial players.

I have been talking about the remaining challenges in the CP and bond markets for awhile, but surprisingly the equity markets have been resilient even while these banks have been working directly with the Federal government on this massive bailout. It seems a bit insincere for the powers-that-be to continue to tout a "strong economy" over the last few weeks while working behind the scenes on staving off a further crisis in our capital markets. These seem to be inconsistent phenomena.

And the fundamentals continue to get worse...and at least one rating agency is finally calling off the formality of putting CDO's on a watch list before continuing to tell the truth about how bad things are getting:

Moody's may accelerate CDO rating cuts after review

Wednesday, October 10, 2007

We Are Not Out Of The Woods

True, the equity markets have rebounded in reaction to the Fed's cut

True, banks have priced and sold a few chunks of High Yield bonds

True, the headlines of the economy sound merrier than they did in August

Nevertheless, all of these facts do not imply that the massive glut of over-liquidity has finished its impact on the system.

Just today the WSJ spelled out the fact that the remaining high yield bond overhang is massive. And coupling this with the fact that GS today reported that its holdings in CDO's and CLO's fell by over 50% last quarter (whether in volume or price it has the same impact) and the fact that Bond investors have openly stated (as noted in an earlier post) that they are not seeing an end to the cycle and you start to get another picture.

Adding to this the fact that GS today disclosed that it has even more assets that "trade so infrequently that there is virtually no reliable market price for them" and strange headlines about CDS traders like: Calyon Trader Fired for Losses Says He's No Rogue and the fact that the real estate market is still in a downward spiral and clouds start to grumble on the horizon.

Maybe I am grumpy just because it is now raining and the summer is over, or maybe it really is getting dark again.

True, banks have priced and sold a few chunks of High Yield bonds

True, the headlines of the economy sound merrier than they did in August

Nevertheless, all of these facts do not imply that the massive glut of over-liquidity has finished its impact on the system.

Just today the WSJ spelled out the fact that the remaining high yield bond overhang is massive. And coupling this with the fact that GS today reported that its holdings in CDO's and CLO's fell by over 50% last quarter (whether in volume or price it has the same impact) and the fact that Bond investors have openly stated (as noted in an earlier post) that they are not seeing an end to the cycle and you start to get another picture.

Adding to this the fact that GS today disclosed that it has even more assets that "trade so infrequently that there is virtually no reliable market price for them" and strange headlines about CDS traders like: Calyon Trader Fired for Losses Says He's No Rogue and the fact that the real estate market is still in a downward spiral and clouds start to grumble on the horizon.

Maybe I am grumpy just because it is now raining and the summer is over, or maybe it really is getting dark again.

Politics As Usual

I normally refrain from political discussion both out of my disdain for the two-party system and out of acknowledgement of the fact that most people are more rabid with their political views than a dog with a porterhouse...

But after seeing all of the ridiculous dialogue in the press about how the GOP's recent predictions that Hillary is inevitably going to beat Obama in the primaries mandates her victory, I had to chime in.

This article is a great example of what I am talking about: Hillary: More Inevitable Than You Think

Did anyone consider this would be a brilliant strategy to pick the easiest candidate to defeat in a general election - deny the possibility that her foes even have a shot?

Once again the Machiavellian nature of the GOP seems to be leaving the Dems grasping for straws...well, at least those who care about a healthy independent competitive presidential election.

I am sure the dynasty-minded are twiddling their fingers with glee.

But after seeing all of the ridiculous dialogue in the press about how the GOP's recent predictions that Hillary is inevitably going to beat Obama in the primaries mandates her victory, I had to chime in.

This article is a great example of what I am talking about: Hillary: More Inevitable Than You Think

How many times did Sen. Hillary Clinton's name come up during Wednesday's Republican debate in Michigan? Twelve.

How many times did Sen. Barack Obama's name come up? Zero.

The bulk of the mentions came from Rudolph Giuliani, who many believe is using Clinton's perceived inevitability to his advantage by declaring himself the Republican candidate best suited to defeat the New York senator in a general election.

Did anyone consider this would be a brilliant strategy to pick the easiest candidate to defeat in a general election - deny the possibility that her foes even have a shot?

Once again the Machiavellian nature of the GOP seems to be leaving the Dems grasping for straws...well, at least those who care about a healthy independent competitive presidential election.

I am sure the dynasty-minded are twiddling their fingers with glee.

Thursday, October 4, 2007

The Worst Is Yet To Come

Although they are laggards, the credit rating agencies, as a following indicator, give us a peak into what we can expect to materialize over the coming six months to a year. When the rating agencies first started to downgrade CDO's and other asset backed securities this summer, it portended the beginning of a volatile and dark period in the credit markets generally.

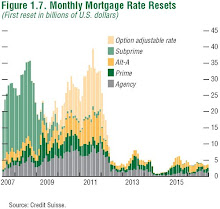

Now, as they have publicly recognized that 2007 vintage subprime mortgages are the worst of any to date, the markets will likely not be as surprised with this new wave of downgrades, although it may suggest that there is more carnage yet to be uncovered as the older vintages "mature" and the wave of ARM's on the right side of this page start to have a greater impact on homeowners.

This article discusses the not-so-pretty rating's outlook: Subprime Delinquencies Accelerating, Moody's Says

Now, as they have publicly recognized that 2007 vintage subprime mortgages are the worst of any to date, the markets will likely not be as surprised with this new wave of downgrades, although it may suggest that there is more carnage yet to be uncovered as the older vintages "mature" and the wave of ARM's on the right side of this page start to have a greater impact on homeowners.

This article discusses the not-so-pretty rating's outlook: Subprime Delinquencies Accelerating, Moody's Says

Wednesday, October 3, 2007

Pessimism

Credit Suisse's Dougan Says Mortgage Turmoil May Last

Bernanke Spoke With Rubin as Credit Crisis Worsened

With that kind of access I think I might be more comfortable predicting a put too. Must be nice to be able to move those multi-billion dollar funds in confidence that your conversations have predictive power.

Credit Suisse Group Chief Executive Officer Brady Dougan said the market for mortgage credit will be ``problematic'' for as long as 18 months.

Bernanke Spoke With Rubin as Credit Crisis Worsened

The Federal Reserve's Aug. 7 decision to keep interest rates unchanged set off a chain of high-level discussions with Wall Street executives, money managers and cabinet officials that culminated in Chairman Ben S. Bernanke's public about-face 10 days later, according to records of his schedule.

Starting with a phone call from former Treasury Secretary Robert Rubin the day after the August rate meeting, Bernanke's appointments included Lewis Ranieri, founder of Hyperion Capital Management Inc., and Raymond Dalio, president of Bridgewater Associates.

With that kind of access I think I might be more comfortable predicting a put too. Must be nice to be able to move those multi-billion dollar funds in confidence that your conversations have predictive power.

Optimism

Credit crunches and buildings fall. The world turns upside down and things we used to count on become the dreams we wish we still had. The sounds of happiness and laughter drift into sounds of yelling and despair and all that we used to hope for gets trapped in dissonance and angst. Call it a bill and obligation or a future hoped for in vain. All these images arise across a country of golden ambers aflame in overzealous pursuit of the dream. I keep hoping we will wake up and see daisies and lilies and sunshine. I think we can.

Tuesday, October 2, 2007

Message From Someone In Need

I got this message today from a friend here at school. Please read this note.

Hello,

My name is Avi Kremer. Three years ago I was a normal, healthy 29-year old. Then I was diagnosed with ALS, also known as Lou Gehrig’s disease. Now I am confined to a wheelchair, and I can barely use my hands. ALS is rapidly destroying all of my physical functions. The disease is fatal and there is no cure. Unless we find one, I will die within three years.

Last year I joined forces with friends and top researchers in the field to found Prize4Life, an innovative non-profit organization that is already removing the obstacles that stand in the way of a cure. But we need your help. We are asking you to give $1 at www.dollar4life.org and to spread the word about our unique campaign. It is your support more than your money that is important – we aim to demonstrate how a large number of small donations can result in meaningful impact. The power of one, times a million, can help us find a cure.

If you choose to give $1 and to tell your friends about the Dollar4Life campaign, if you put the information on your blog and on your website, if people see it and they give and tell people too, then that $1 will quickly become $100 and then $1,000 and eventually $1 million. That $1 million could save my life and the lives of the 500,000 people around the world who have ALS.

Please go to www.dollar4life.org to make your donation. Each donation will light up a pixel in the portrait gallery of ALS patients on the website. We hope that with your help we will light up one million pixels and brighten the life prospects of ALS patients everywhere.

To learn more about the Dollar4Life campaign and Prize4Life*, the organization that will receive the full amount of every donation, please visit www.dollar4life.org. If you would like to contribute with a check, please make it payable to Prize4Life, Inc. and address it to P.O. Box 381708, Cambridge, MA 02238-1708.

Thank you,

Avi

Hello,

My name is Avi Kremer. Three years ago I was a normal, healthy 29-year old. Then I was diagnosed with ALS, also known as Lou Gehrig’s disease. Now I am confined to a wheelchair, and I can barely use my hands. ALS is rapidly destroying all of my physical functions. The disease is fatal and there is no cure. Unless we find one, I will die within three years.

Last year I joined forces with friends and top researchers in the field to found Prize4Life, an innovative non-profit organization that is already removing the obstacles that stand in the way of a cure. But we need your help. We are asking you to give $1 at www.dollar4life.org and to spread the word about our unique campaign. It is your support more than your money that is important – we aim to demonstrate how a large number of small donations can result in meaningful impact. The power of one, times a million, can help us find a cure.

If you choose to give $1 and to tell your friends about the Dollar4Life campaign, if you put the information on your blog and on your website, if people see it and they give and tell people too, then that $1 will quickly become $100 and then $1,000 and eventually $1 million. That $1 million could save my life and the lives of the 500,000 people around the world who have ALS.

Please go to www.dollar4life.org to make your donation. Each donation will light up a pixel in the portrait gallery of ALS patients on the website. We hope that with your help we will light up one million pixels and brighten the life prospects of ALS patients everywhere.

To learn more about the Dollar4Life campaign and Prize4Life*, the organization that will receive the full amount of every donation, please visit www.dollar4life.org. If you would like to contribute with a check, please make it payable to Prize4Life, Inc. and address it to P.O. Box 381708, Cambridge, MA 02238-1708.

Thank you,

Avi

The Understatement of The Year

Greenspan Sees `Rethinking' on CDOs After Losses

Although the equity markets regained their footing and have now surpassed the peak set this summer, the credit markets continue to be in difficult shape, highlighted by Citigroup's announcement yesterday that they will take a huge loss based on writing down some of their credit assets.

I try not to be a cynic, but the more I think about this, the more it looks like the froth in the equity markets is benefitting the have's (i.e. the slice of American's who can afford to have a piece of this pie), while the have-nots are continuing to be left in the dust of a crumbling real estate market with their dollars depreciating against not only currencies of countries they may never visit, but also against stuff like oil, wheat, and platinum.

If this is true it comports with the concept of the rich having power over Washington and through that power the Fed...

But it also comports with the idea that the increased leverage in the system makes the equity markets more volatile - on both the upside and the downside - so that what we are seeing now is a volatile move in reaction to the base stimulus provided by the Fed.

I have never claimed to be able to predict the next move in something like the Dow or Nasdaq, so I won't start yet...I just think if Greenspan is only now acknowledging CDO's may have to be revised, we have a long time until the system digests just how bad things got in the credit markets. Some big investors tend to agree: Fed Fails to Restore Creditor Confidence, Pimco Says

Although the equity markets regained their footing and have now surpassed the peak set this summer, the credit markets continue to be in difficult shape, highlighted by Citigroup's announcement yesterday that they will take a huge loss based on writing down some of their credit assets.

I try not to be a cynic, but the more I think about this, the more it looks like the froth in the equity markets is benefitting the have's (i.e. the slice of American's who can afford to have a piece of this pie), while the have-nots are continuing to be left in the dust of a crumbling real estate market with their dollars depreciating against not only currencies of countries they may never visit, but also against stuff like oil, wheat, and platinum.

If this is true it comports with the concept of the rich having power over Washington and through that power the Fed...

But it also comports with the idea that the increased leverage in the system makes the equity markets more volatile - on both the upside and the downside - so that what we are seeing now is a volatile move in reaction to the base stimulus provided by the Fed.

I have never claimed to be able to predict the next move in something like the Dow or Nasdaq, so I won't start yet...I just think if Greenspan is only now acknowledging CDO's may have to be revised, we have a long time until the system digests just how bad things got in the credit markets. Some big investors tend to agree: Fed Fails to Restore Creditor Confidence, Pimco Says

Subscribe to:

Posts (Atom)