In another move indicating that Mr. Paulson has experience outside of Washington he appears to be poised to suggest a new set of regulators and consolidated roles among Washington beaurocrats. The moves are discussed here: Paulson to Propose New Regulators, SEC-CFTC Merger and here: Treasury’s Plan Would Give Fed Wide New Power

Acknowledging that part of the cause of the current crisis was a failure in oversight is an honest step in the right direction and suggests hope for the future. The fact that a conservative-minded former business executive with as much credibility as Mr. Paulson is doing this suggests that perhaps even those with a "leave things they way they are" form of conservatism might be willing to listen.

There is no question in my mind that our government needs to innovate if it wants to have a chance to keep pace with the breakneck speed of financial wizardry. By creating a leaner, more well organized, and more focused regulatory body perhaps we can accomplish such a lofty goal in the future and prevent future calamities like the one we have been watching unfold over the last year.

Now if only they would extend their reach to the rating agencies...one can only hope for so much I guess.

Friday, March 28, 2008

Monday, March 24, 2008

Finding A Bottom

A number of you have asked me when I think housing prices will bottom. The short answer is: I have no idea, but most smart people I have asked think it will be 2010 before housing prices stop falling.

Here is a realistic view from Irvine Housing Blog that suggests that in least in the Los Angeles market, it will likely be 2011 before we reach a bottom based on historical S&P/Case-Shiller forecasts.

In any event, there appears to be a lot more pain for individual homeowners left to come. Hopefully some of the liquidity pumped into the system over the last few weeks will help to dampen the blow in the form of more reasonable renegotiations and restructuring with individual homeowners who are facing the prospect of foreclosure.

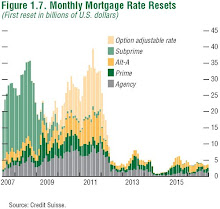

It seems like it is in the banks' collective self-interest to reduce the excess supply of housing as the wave of adjustments in a wide variety of exotic mortgages continues to play out.

Here is a realistic view from Irvine Housing Blog that suggests that in least in the Los Angeles market, it will likely be 2011 before we reach a bottom based on historical S&P/Case-Shiller forecasts.

In any event, there appears to be a lot more pain for individual homeowners left to come. Hopefully some of the liquidity pumped into the system over the last few weeks will help to dampen the blow in the form of more reasonable renegotiations and restructuring with individual homeowners who are facing the prospect of foreclosure.

It seems like it is in the banks' collective self-interest to reduce the excess supply of housing as the wave of adjustments in a wide variety of exotic mortgages continues to play out.

Sunday, March 23, 2008

No More Room

Courtesy of Paul Krugman's commentary on Weird Interest Rates

There does not appear to be much more room for the Fed to move the needle with liquidity.

Always, that is, until now. Treasury rates have plunged close to zero, even though Fed funds is still 2.25%. Since open-market operations take place in Treasuries, I take this to mean that the Fed may not actually be able to reduce short-term rates much from current levels — which means, in turn, that conventional monetary policy has been taken off the table.

There does not appear to be much more room for the Fed to move the needle with liquidity.

Friday, March 21, 2008

Desparate For Good News

Goldman, Lehman Reduce Loan Backlog With Discounts

Apparently people are treating this as if it is good news. I would not take it as such at face value, but any momentum out of the logjam of February is a positive sign.

U.S. banks from Goldman Sachs Group Inc. to Lehman Brothers Holdings Inc. have whittled their holdings of leveraged buyout loans to $129 billion from $163 billion at the beginning of the year by offering the debt at discounts, according to analysts at Bank of America Corp.

The decline is a ``ray of hope'' for banks amid a slump in credit markets and a slowing economy, said analysts led by Jeffrey Rosenberg. The firms also have $73.6 billion of high- yield bonds they need to sell, they said.

Apparently people are treating this as if it is good news. I would not take it as such at face value, but any momentum out of the logjam of February is a positive sign.

Sunday, March 16, 2008

Greenspan On Uncertainty

Alan Greenspan recognizes in clear terms one of the fundamental problems with our current financial system, as enunciated in the title of his oped: We will never have a perfect model of risk

This sentiment is similar to that which motivates my distaste for "quant funds" or other overly complex sets of financial analyses. When building a house the foundation is important, but it can be somewhat imperfect and the house still stands. But when building a tower, one had better be certain that the foundation is secure.

The elegantly complex models of correlations and statistical almost-truths piled upon estimations of human behavior work in times of human consistency. But when people change their minds, or behave in innovative, stupid, or perhaps just rationally greedy ways, it is sometimes hard to predict the outcomes. And as we are seeing, being wrong with a multi-Trillion dollar tower of financial assets on top of our assumptions produces dislocations that can be somewhat painful.

The essential problem is that our models – both risk models and econometric models – as complex as they have become, are still too simple to capture the full array of governing variables that drive global economic reality. A model, of necessity, is an abstraction from the full detail of the real world. In line with the time-honoured observation that diversification lowers risk, computers crunched reams of historical data in quest of negative correlations between prices of tradeable assets; correlations that could help insulate investment portfolios from the broad swings in an economy. When such asset prices, rather than offsetting each other’s movements, fell in unison on and following August 9 last year, huge losses across virtually all risk-asset classes ensued.

The most credible explanation of why risk management based on state-of-the-art statistical models can perform so poorly is that the underlying data used to estimate a model’s structure are drawn generally from both periods of euphoria and periods of fear, that is, from regimes with importantly different dynamics.

...

But these models do not fully capture what I believe has been, to date, only a peripheral addendum to business-cycle and financial modelling – the innate human responses that result in swings between euphoria and fear that repeat themselves generation after generation with little evidence of a learning curve.

...

Anticipated events are arbitraged away. But if, as I strongly suspect, periods of euphoria are very difficult to suppress as they build, they will not collapse until the speculative fever breaks on its own. Paradoxically, to the extent risk management succeeds in identifying such episodes, it can prolong and enlarge the period of euphoria. But risk management can never reach perfection. It will eventually fail and a disturbing reality will be laid bare, prompting an unexpected and sharp discontinuous response.

This sentiment is similar to that which motivates my distaste for "quant funds" or other overly complex sets of financial analyses. When building a house the foundation is important, but it can be somewhat imperfect and the house still stands. But when building a tower, one had better be certain that the foundation is secure.

The elegantly complex models of correlations and statistical almost-truths piled upon estimations of human behavior work in times of human consistency. But when people change their minds, or behave in innovative, stupid, or perhaps just rationally greedy ways, it is sometimes hard to predict the outcomes. And as we are seeing, being wrong with a multi-Trillion dollar tower of financial assets on top of our assumptions produces dislocations that can be somewhat painful.

Fear And Distrust

After Friday's Bailout of Bear Stearns, less than 2 days later, it turns out that the Fed has encouraged a deal in which JP Morgan has agreed to completely bail out the company for $2/share.

J.P. Morgan Rescues Bear Stearns

Falling into the "careful what you wish for camp" this quote jumps out:

In other words, the same financial institutions who lobbied to change the bankruptcy code only a few years ago are likely now regretting such a decision as the ability to slow down collateral calls and liquidations with a bankruptcy filing is now a less viable option.

If this doesn't wake up anyone who hasn't been fearing a major catastrophe nothing will.

The Fed has been moving fast over the weekend broading the liquidity back stop announced last week.

U.S. Fed Cuts Discount Rate, Says Dealers May Borrow

The credit markets have been anticipating this over the last month. These charts of the CDX indices express the fear that we are now seeing in equities:

There are many people prognosticating how the system could continue to unravel such as in this article in the NY Times published over the weekend: A Wall Street Domino Theory

This simple quote from the article underpins the biggest challenge facing the markets today: "In a trading firm, trust is everything".

The underlying principle guiding indices like the "consumer confidence" index and the like reflect the fact that our economy and markets are predicated upon a confidence in a world of limited information.

The unraveling of AAA-rated entities and now a blue-chip financial institution call into doubt basic assumptions upon which people's build their understanding of the economy and markets.

At this point I am starting to support the Fed in its efforts to prevent calamity primarily because I feel that the situation has gotten so dire that a lack of action could have brutal consequences...I prefer the "bull" part of my psyche and can't wait for days when it can dominate the discussion again.

J.P. Morgan Rescues Bear Stearns

Bear Stearns Cos. reached an agreement to sell itself to J.P. Morgan Chase & Co., as worries grew that failing to find a buyer for the beleaguered investment bank could cause the crisis of confidence gripping Wall Street to worsen.

The deal calls for J.P. Morgan to pay $2 a share in a stock-swap transaction, with J.P. Morgan Chase exchanging 0.05473 share of its common stock for each Bear Stearns share. Both companies' boards have approved the transaction, which values Bear Stearns at just $236 million based on the number of shares outstanding as of Feb. 16. At Friday's close, Bear Stearns's stock-market value was about $3.54 billion

Falling into the "careful what you wish for camp" this quote jumps out:

"Bankruptcy experts said filing for bankruptcy protection wouldn't have been an attractive option for Bear Stearns, partly due to recent changes in the federal Bankruptcy Code relating to financial instruments like derivatives and repurchasing trades. Unlike most parties in bankruptcy, lenders in such transactions aren't stayed or prevented from acting to seize or control the assets involved in those deals."

In other words, the same financial institutions who lobbied to change the bankruptcy code only a few years ago are likely now regretting such a decision as the ability to slow down collateral calls and liquidations with a bankruptcy filing is now a less viable option.

If this doesn't wake up anyone who hasn't been fearing a major catastrophe nothing will.

The Fed has been moving fast over the weekend broading the liquidity back stop announced last week.

U.S. Fed Cuts Discount Rate, Says Dealers May Borrow

The Federal Reserve, in an emergency weekend decision, cut the rate on direct loans to commercial banks and opened up borrowing at the rate to primary dealers in government securities.

The credit markets have been anticipating this over the last month. These charts of the CDX indices express the fear that we are now seeing in equities:

There are many people prognosticating how the system could continue to unravel such as in this article in the NY Times published over the weekend: A Wall Street Domino Theory

This simple quote from the article underpins the biggest challenge facing the markets today: "In a trading firm, trust is everything".

The underlying principle guiding indices like the "consumer confidence" index and the like reflect the fact that our economy and markets are predicated upon a confidence in a world of limited information.

The unraveling of AAA-rated entities and now a blue-chip financial institution call into doubt basic assumptions upon which people's build their understanding of the economy and markets.

At this point I am starting to support the Fed in its efforts to prevent calamity primarily because I feel that the situation has gotten so dire that a lack of action could have brutal consequences...I prefer the "bull" part of my psyche and can't wait for days when it can dominate the discussion again.

Wednesday, March 12, 2008

Reason May Prevail

Paulson, Bernanke Plan Tougher Scrutiny of U.S. Banks

This is a reassuring companion to the bail out announced yesterday. An honest and clear assessment of the excesses of the CDO market (among other financial innovations) will lead one to conclude that banks, originators, credit rating agencies, mortgage brokers, and borrowers (yes borrowers too) were far to eager to perpetuate the glut of liquidity fueled leverage-consumption in the form of home "ownership" over the last half-decade.

In addition, lax regulation and underwriting by buyers of these products led to an all-too-easy ability for banks to "remove risks" from their balance sheets so as to avoid capital requirements intended to prevent bank failures.

Paulson's public acknowledgment that such an arrangement is simply unacceptable and unsustainable is to be admired as one of tempered admonishment with an eye to constructive reform.

If only all leaders could show such balance in their public decision-making we might be able to avoid future catastrophes like the one we are continuing to witness today.

This is a reassuring companion to the bail out announced yesterday. An honest and clear assessment of the excesses of the CDO market (among other financial innovations) will lead one to conclude that banks, originators, credit rating agencies, mortgage brokers, and borrowers (yes borrowers too) were far to eager to perpetuate the glut of liquidity fueled leverage-consumption in the form of home "ownership" over the last half-decade.

In addition, lax regulation and underwriting by buyers of these products led to an all-too-easy ability for banks to "remove risks" from their balance sheets so as to avoid capital requirements intended to prevent bank failures.

Paulson's public acknowledgment that such an arrangement is simply unacceptable and unsustainable is to be admired as one of tempered admonishment with an eye to constructive reform.

If only all leaders could show such balance in their public decision-making we might be able to avoid future catastrophes like the one we are continuing to witness today.

Tuesday, March 11, 2008

The Put Is Here To Stay

In case you were on another planet today, the stock market popped the most it has since 2002 after the Fed announced that it is going to bail out bad banking decisions at the expense of the American Taxpayer.

The details are discussed here: Fed's Loan Rescue Sparks Big Stock Rally: Fed Offers $200 Billion to Prop Up Lenders; Wall Street Responds With Huge Rally

The short answer for what this means is that for the first time, the Fed is going to accept mortgage backed securities as collateral for high quality government assets. In plain english: the government is going to take the risk on mortgage-backed securities that no one else is willing to buy.

I understand there has been some madness in the markets over the last few days, with hedge fund liquidations and the like: Hedge Funds Reel From Margin Calls Even on Treasuries. But does that mean that the American taxpayer should step in and bail these bad decision-makers out?

If we are going to use taxpayer dollars, why not actually restructure individual homeowners loans or do more of the stimulus minded stuff like the recent decision to give all Americans a bit of extra spending money?

The reality is: this is only the beginning of the implicit "put" option that the Federal Government has given banks by allowing them to create any kind of securitized vehicle they like without any oversight.

What today's announcement says, and what the market seems to have heard is, "Don't worry, we will do whatever we can to keep everyone afloat". While this might be good to stave off today's armageddon, deferring the pain until another day will only make it fall on another party - and this time the American taxpayer is footing the bill.

The details are discussed here: Fed's Loan Rescue Sparks Big Stock Rally: Fed Offers $200 Billion to Prop Up Lenders; Wall Street Responds With Huge Rally

The short answer for what this means is that for the first time, the Fed is going to accept mortgage backed securities as collateral for high quality government assets. In plain english: the government is going to take the risk on mortgage-backed securities that no one else is willing to buy.

I understand there has been some madness in the markets over the last few days, with hedge fund liquidations and the like: Hedge Funds Reel From Margin Calls Even on Treasuries. But does that mean that the American taxpayer should step in and bail these bad decision-makers out?

If we are going to use taxpayer dollars, why not actually restructure individual homeowners loans or do more of the stimulus minded stuff like the recent decision to give all Americans a bit of extra spending money?

The reality is: this is only the beginning of the implicit "put" option that the Federal Government has given banks by allowing them to create any kind of securitized vehicle they like without any oversight.

What today's announcement says, and what the market seems to have heard is, "Don't worry, we will do whatever we can to keep everyone afloat". While this might be good to stave off today's armageddon, deferring the pain until another day will only make it fall on another party - and this time the American taxpayer is footing the bill.

Thursday, March 6, 2008

Don't Trust Your Model

This article makes me laugh inside: Credit Swaps Thwart Fed's Ease as Debt Costs Surge

The punch line of the article, similar to the signs we have seen at quant hedge funds is that we are not as smart as we thought we were.

In other words, the same over-confidence that led people to believe that they could construct complex derivatives at a ridiculously breakneck pace without changing the nature of the financial system is now leading to models that just don't work. To me this is another symptom of a society that has become to easily convinced by "proof" through statistical regression. Statistics are useful and powerful, especially in the context of scientific and medical research. However, once one leaves the sciences and moves into areas that involve human beings and even more complex systems like international financial markets, the idea that we can build a model to predict the future becomes less believable.

At a very simple level, if it was so easy to predict what was going to happen tomorrow, no one would make money by investing because all of this information would be priced into today's security values. The so-called efficient market hypothesis reflects this basic intuition.

The problem is: predicting the future is ridiculously hard in one person's life, not to mention trying to do it for a group of people, a society of people, or the world markets as a whole. Add in some leverage, a multi-trillion dollar market of obscure and complex derivatives, some people falling on rough times underneath the whole thing, and you are left with a system fluctuating out of control.

What will slow down the volatility and bring us back down to reality? Hard to know, but one thing is clear: don't trust the model.

The punch line of the article, similar to the signs we have seen at quant hedge funds is that we are not as smart as we thought we were.

In other words, the same over-confidence that led people to believe that they could construct complex derivatives at a ridiculously breakneck pace without changing the nature of the financial system is now leading to models that just don't work. To me this is another symptom of a society that has become to easily convinced by "proof" through statistical regression. Statistics are useful and powerful, especially in the context of scientific and medical research. However, once one leaves the sciences and moves into areas that involve human beings and even more complex systems like international financial markets, the idea that we can build a model to predict the future becomes less believable.

At a very simple level, if it was so easy to predict what was going to happen tomorrow, no one would make money by investing because all of this information would be priced into today's security values. The so-called efficient market hypothesis reflects this basic intuition.

The problem is: predicting the future is ridiculously hard in one person's life, not to mention trying to do it for a group of people, a society of people, or the world markets as a whole. Add in some leverage, a multi-trillion dollar market of obscure and complex derivatives, some people falling on rough times underneath the whole thing, and you are left with a system fluctuating out of control.

What will slow down the volatility and bring us back down to reality? Hard to know, but one thing is clear: don't trust the model.

Saving The Bank

It looks like my intuitions about regulatory capital and bank failures are starting to materialize in a major way at Citi.

This paints a dark picture for those hoping that the fed interest rate cuts would stem a decline in the housing market Citigroup to Pare Mortgage Holdings by $45 Billion

Plain and simple this is a sign that this staple of the American banking system is under dire pressure to ensure its survival. Combining these comments with rumors the other day that middle east investors are concerned for the bank's survival and the overall situation in the credit market, makes it seem like it will be quite some time before normal conditions return to the mortgage markets putting even more pressure on an already declining system.

This is unfortunate and sad news for homeowners looking to refinance or for those hoping to buy a home as contractions in the supply of capital will only make a dark situation worse.

Let's hope that this is enough to stave off disaster rather than the usual sign of worse things yet to come.

This paints a dark picture for those hoping that the fed interest rate cuts would stem a decline in the housing market Citigroup to Pare Mortgage Holdings by $45 Billion

Citigroup Inc., the fourth-largest U.S. home lender by new loan volume, plans to pare its U.S. residential unit's mortgage and home-equity holdings by about $45 billion, or 20 percent, over the next year.

...

Paring back mortgage holdings may help reduce Citigroup's capital needs by $4 billion to $6 billion

Plain and simple this is a sign that this staple of the American banking system is under dire pressure to ensure its survival. Combining these comments with rumors the other day that middle east investors are concerned for the bank's survival and the overall situation in the credit market, makes it seem like it will be quite some time before normal conditions return to the mortgage markets putting even more pressure on an already declining system.

This is unfortunate and sad news for homeowners looking to refinance or for those hoping to buy a home as contractions in the supply of capital will only make a dark situation worse.

Let's hope that this is enough to stave off disaster rather than the usual sign of worse things yet to come.

Monday, March 3, 2008

Bankruptcy Filings Surge

More unsurprising but worsening data

Bankruptcy Filings Surge Among US Consumers

Bankruptcy Filings Surge Among US Consumers

American consumers' bankruptcy filings jumped 15 percent in February from the previous month and a steeper rise is looming because of the subprime mortgage crisis, the American Bankruptcy Institute said.

Consumer bankruptcy filings in February totaled 76,120, up from 66,050 recorded in January, the non-partisan bankruptcy research group said.

The February number was 37 percent higher than in the same month a year ago, according to the institute

Home Foreclosures Keep Growing

This is unsurprising for those of us paying attention, although it is troubling nonetheless. Via NYTimes: In Parts of U.S., Foreclosures Top Sales

The pace of this mess appears to continue to increase.

According to this video from a dude at the Harvard Center for Joint Housing Studies, he sees a bottom at no later than December 2009. Many others are thinking late 2010. I heard that billionaire Sam Zell was on CNBC saying we will have a bottom in a few months...he must have been talking about megacap value equities or something.

During January, it was reported this week by RealtyTrac, there were 153,745 initial foreclosure notices sent out in the United States. That dwarfed the 43,000 total sales of newly built single-family homes and amounted to nearly half the total sales figure, which includes sales of existing homes and condominiums.

The pace of this mess appears to continue to increase.

According to this video from a dude at the Harvard Center for Joint Housing Studies, he sees a bottom at no later than December 2009. Many others are thinking late 2010. I heard that billionaire Sam Zell was on CNBC saying we will have a bottom in a few months...he must have been talking about megacap value equities or something.

Subscribe to:

Posts (Atom)